Want to Learn About Titanium Dioxide Pigments? This Article Has You Covered!

Titanium Dioxide Pigment: The Third Largest Inorganic Chemical Product After Synthetic Ammonia and Phosphates — Do You Know It Well?

Titanium dioxide (TiO₂) can be classified into pigment-grade and non-pigment-grade based on usage. Among them, rutile-type titanium dioxide possesses better chemical stability. TiO₂ has extensive downstream applications, mainly in high-grade exterior coatings, latex paints, premium paper, and rubber materials. The coatings industry is the primary downstream sector, accounting for over 50% of TiO₂ consumption.

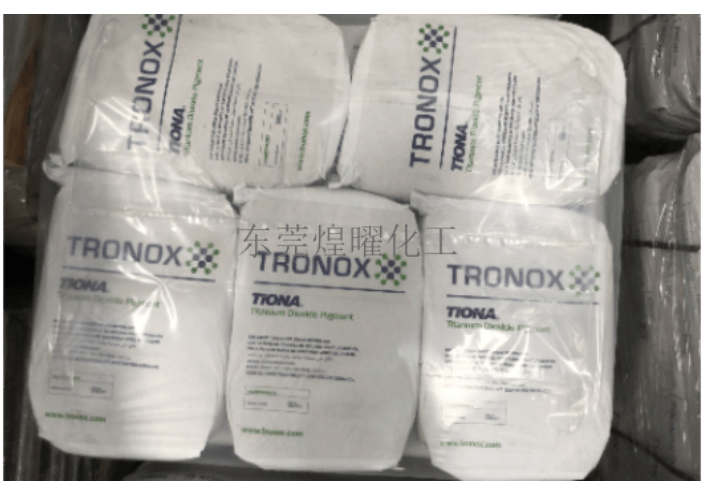

Since the 1990s, the TiO₂ industry has undergone continuous consolidation, resulting in a relatively clear leading enterprise structure. In the past decade, major market share changes mainly occurred among large companies. In 2016, Tronox acquired Cristal, rising to become the world’s second-largest TiO₂ producer. In 2015, the merger of Longbai Group and Huntsman formed the world’s third-largest TiO₂ enterprise. DuPont and Huntsman separated their coatings-related businesses into Chemours and Venator, respectively.

Although China accounts for 42% of global TiO₂ production capacity, most domestic companies have relatively small scales, with a significant gap compared to overseas leaders. After mergers led by Longbai Group, by 2019, China’s TiO₂ supply was dominated by several large groups including Longbai Group, China National Nuclear TiO₂, Shandong Dongjia, Jinpu Titanium, and Pangang Group. These five accounted for half of China’s total TiO₂ capacity.

There are two main processes for TiO₂ production: the sulfate process and the chloride process. The sulfate process has a longer production flow and relatively lower automation; the chloride process features shorter flows, easier capacity expansion, higher continuous automation, lower energy consumption, and fewer emissions. Globally, the chloride process dominates overseas production, while in China, due to key technology and equipment constraints, the sulfate process remains predominant. However, companies like Longbai and Yibin Tianyuan have started gradually adopting chloride process lines. Globally, chloride process accounts for about 55% of TiO₂ production, slightly higher than sulfate process. The chloride process technology was developed and commercialized by DuPont, is mature, and is adopted by many advanced foreign manufacturers with a share over 80%. Due to the technical barriers of chloride process in China, only Longbai, Jinzhou Titanium, Yunnan Xinli, and Luohe Xingmao possess chloride process capacities of around 60,000 tons/year each.